This post is part of the "Strategic Growth Series: 11 Key Operational Areas for Success" series, which covers the 11 essential operational areas that every service-based business needs to master. In this segment - segment #5, I focus on why every business needs a risk management plan and how to create one to protect your business.

Introduction: In the ever-changing landscape of business, risk is an inherent part of the journey. Whether it’s financial uncertainty, legal challenges, operational disruptions, or market volatility, every business faces risks that can threaten its success. The key to navigating these uncertainties is having a robust risk management plan in place. A well-crafted plan helps you identify, assess, and mitigate potential risks, ensuring that your business remains resilient in the face of challenges. In this post, I’ll explore why every business needs a risk management plan and how to create one that safeguards your business.

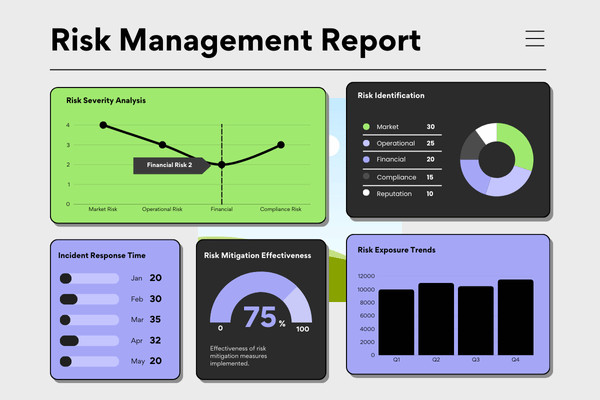

Section 1: Understanding Business Risks. Business risks come in many forms, and understanding them is the first step toward effective management. Common types of risks include:

- Financial Risks: These involve potential losses due to economic downturns, cash flow issues, or poor financial management. They can affect your ability to meet obligations and invest in growth.

- Operational Risks: These arise from internal processes, systems, or people and can disrupt your day-to-day operations. Examples include software failures, equipment breakdowns, or employee errors.

- Legal and Compliance Risks: These involve the possibility of legal action due to non-compliance with laws, regulations, or contracts. Failing to comply can result in fines, lawsuits, or reputational damage.

- Market Risks: These are external risks that arise from changes in the market environment, such as shifts in customer preferences, increased competition, or economic downturns.

- Reputational Risks: These involve the potential loss of reputation due to negative public perception, customer dissatisfaction, or scandals. A damaged reputation can lead to loss of customers and revenue.

Section 2: Why Every Business Needs a Risk Management Plan. A risk management plan is essential for several reasons:

- Proactive Risk Identification: A risk management plan allows you to proactively identify potential risks before they become major issues. By anticipating challenges, you can take steps to mitigate them.

- Enhanced Decision-Making: Understanding the risks associated with different business decisions helps you make more informed choices, balancing potential rewards against potential downsides.

- Business Continuity: A risk management plan ensures that your business can continue operating even in the face of unexpected disruptions. It helps you develop contingency plans and maintain stability during crises.

- Financial Protection: By identifying financial risks and creating strategies to mitigate them, you can protect your business’s financial health and ensure long-term viability.

- Compliance Assurance: A risk management plan helps you stay compliant with laws and regulations, reducing the likelihood of legal issues and fines.

Section 3: How to Create an Effective Risk Management Plan. Creating a risk management plan involves several key steps:

- Identify Potential Risks: Start by brainstorming all possible risks that could impact your business. Consider financial, operational, legal, market, and reputational risks.

- Example: If you run an e-commerce business, consider risks like website downtime, cyberattacks, and client disputes.

- Assess Risk Impact: Evaluate the likelihood and potential impact of each risk. Prioritize risks that could have the most significant effect on your business.

- Example: A cyberattack could have a high impact on your business, leading to data breaches and loss of customer trust.

- Develop Mitigation Strategies: For each identified risk, develop strategies to minimize its impact. This could involve preventive measures, contingency plans, or transferring the risk through insurance.

- Example: Implement cybersecurity measures, such as firewalls and encryption, and create a response plan for data breaches.

- Monitor and Review: Regularly review your risk management plan to ensure it remains relevant. Update it as your business grows, and new risks emerge.

- Example: Conduct quarterly risk assessments and adjust your plan based on changes in your business environment.

Section 4: The Benefits of a Strong Risk Management Plan. Having a robust risk management plan offers several benefits:

- Increased Confidence: Knowing that you have a plan in place to handle potential risks gives you greater confidence in making strategic decisions and pursuing growth opportunities.

- Improved Business Reputation: Demonstrating a proactive approach to risk management can enhance your business’s reputation with customers, investors, and partners.

- Better Resource Allocation: By identifying and prioritizing risks, you can allocate resources more effectively, focusing on areas that require the most attention.

- Long-Term Success: Ultimately, a strong risk management plan helps ensure the long-term success and sustainability of your business.

Conclusion: Every business, regardless of size or industry, faces risks. Having a comprehensive risk management plan is essential to navigate these uncertainties and protect your business’s future. By identifying potential risks, assessing their impact, and developing strategies to mitigate them, you can safeguard your business and ensure its resilience.

FREE RESOURCE

Ready to protect your business from uncertainty and ensure long-term success? Download my FREE Business Strategy Self-Audit Workbook by clicking HERE. This comprehensive guide covers all 11 essential operational areas every service-based business must master—including Risk Management. Use it to identify potential risks, develop mitigation strategies, and create a robust plan that keeps your business resilient and thriving.

JOIN THE CONVERSATION!

What’s the biggest risk your business has faced, and how did you navigate it? Do you have a risk management plan in place, or is this an area you’re still working on? Share your experiences and insights in the comments—I’d love to hear how you approach safeguarding your business!

This post is part of the "Strategic Growth Series: 11 Key Operational Areas for Success" series, which covers the 11 essential operational areas that every service-based business needs to master. In this segment - segment #3, I focus on the power of regular strategic reviews and continuous improvement to ensure long-term success.

Introduction: In today’s fast-paced business environment, standing still is not an option. To stay competitive and achieve long-term success, service-based entrepreneurs must regularly assess their strategies and continuously seek ways to improve. Regular strategic reviews and a commitment to continuous improvement are essential practices for anyone wanting to remain agile, responsive, and successful. In this post, I’ll explore the power of strategic reviews and continuous improvement, why they are crucial, and how to implement them effectively in your business.

Section 1: Why Regular Strategic Reviews Are Essential. Strategic reviews involve assessing your business strategy to ensure that it aligns with your current goals, market conditions, and performance. Here’s why regular reviews are so important:

- Adaptation to Change: The business environment is constantly evolving. Regular strategic reviews allow you to adapt your strategy to new market conditions, customer needs, and competitive pressures.

- Alignment with Goals: As your business grows and evolves, your goals may change. Strategic reviews ensure that your business strategy remains aligned with your current objectives.

- Identification of Opportunities: By regularly reviewing your strategy, you can identify new opportunities for growth, innovation, and improvement that may have been overlooked.

- Mitigation of Risks: Strategic reviews help you identify potential risks and challenges early, allowing you to take proactive measures to mitigate them.

Section 2: The Role of Continuous Improvement. Continuous improvement is the ongoing effort to enhance your services, processes, and strategies. It’s about making small, incremental changes that lead to significant long-term results. Here’s why continuous improvement matters:

- Enhanced Efficiency: Continuous improvement helps you streamline processes, reduce waste, and improve efficiency, leading to cost savings and better resource allocation.

- Increased Competitiveness: By continuously improving, you stay ahead of competitors, offering better services and customer experiences.

- Personal and Professional Growth: A culture of continuous improvement encourages your own development, as well as the growth of any team members, leading to more innovative and effective service delivery.

- Sustained Growth: Continuous improvement fosters a mindset of learning and adaptation, ensuring that your business remains dynamic and capable of sustained growth.

Section 3: How to Conduct Effective Strategic Reviews. To get the most out of your strategic reviews, follow these steps:

- Set Clear Objectives: Determine what you want to achieve with your strategic review. Are you looking to align with new goals, address performance issues, or explore new opportunities?

- Example: Set an objective to evaluate the effectiveness of your current client onboarding process and identify areas for improvement.

- Gather Data: Collect relevant data on your business’s performance, client feedback, and market trends. This data will inform your review and help you make data-driven decisions.

- Example: Analyze client feedback, review your service delivery timelines, and assess market trends to gain insights into your current performance.

- Involve a Peer Group or Mentor: If you don’t have a leadership team, consider involving a peer group, mentor, or business strategy coach in the review process. Their outside perspective can provide valuable insights and help you identify blind spots.

- Example: Discuss your strategic review findings with a business strategy coach or mentor to gain additional perspectives and advice on potential improvements.

- Analyze and Evaluate: Review the data and feedback you’ve collected to identify strengths, weaknesses, opportunities, and threats (SWOT analysis). Assess whether your current strategy is still relevant and effective.

- Example: Conduct a SWOT analysis to evaluate your current service offerings and identify areas that need adjustment or innovation.

- Develop Action Plans: Based on your analysis, develop action plans to address any gaps or opportunities. Set clear goals, timelines, and responsibilities for implementing these changes.

- Example: Create an action plan to enhance your client follow-up process, with specific goals for increasing client satisfaction and retention.

Section 4: How to Foster a Culture of Continuous Improvement. To embed continuous improvement into your business culture, consider these strategies:

- Encourage Idea Generation: Create a system where you can regularly assess your processes and service offerings. Regular self-reflection and client feedback are crucial.

- Example: Schedule monthly or quarterly reflections where you evaluate your service delivery and identify areas for improvement based on client feedback.

- Implement Small Changes: Focus on making small, incremental changes that are easier to implement and sustain. Over time, these small changes can lead to significant improvements.

- Example: Introduce a new tool to automate client communication and see how it impacts your efficiency and client satisfaction.

- Monitor and Measure: Track the impact of continuous improvement initiatives to ensure they are delivering the desired results. Use KPIs (Key Performance Indicators) to measure progress and make adjustments as needed.

- Example: Monitor client satisfaction scores and project completion times to gauge the success of your improvement efforts.

- Promote a Learning Culture: Engage in continuous learning by seeking out new skills and knowledge relevant to your industry. This will help you stay on the cutting edge and drive continuous improvement.

- Example: Take online courses or attend workshops to keep your skills sharp and your business practices up-to-date.

Conclusion: Regular strategic reviews and a commitment to continuous improvement are powerful tools for driving business success. By regularly assessing your strategy and making incremental improvements, you can ensure that your business remains agile, competitive, and positioned for long-term growth.

FREE RESOURCE

Ready to stay agile and drive long-term growth in your business? Download my FREE Business Strategy Self-Audit Workbook by clicking HERE. This comprehensive guide covers all 11 essential operational areas every service-based business must master—including Strategic Reviews and Continuous Improvement. Use it to assess your current strategies, uncover areas for enhancement, and ensure your business remains dynamic, competitive, and successful.

JOIN THE CONVERSATION!

How often do you review your business strategies and make improvements? What challenges have you faced in staying consistent with this process, and how has it impacted your business growth? Share your experiences in the comments—I’d love to hear how you approach continuous improvement and connect with you!